Are RPA and AI living up to the hype?

Sarah Fane:

So earlier this year Highradius commissioned us to conduct a study about to what extent people are actually using RPA and AI? Are they living up to the high expectations that we’ve had for them, and where are the main challenges? So just when we talk about hype, I think it is just helpful to touch on Gartner’s hype cycle. You may be familiar with this, that whenever a new introduced in new technology like RPA, or AI is introduced, we have a peak of inflated expectations, people think this will this technology is going to make my life better, the robots are going to take over and maybe finance could just put their feet up, then we start realizing some of the limitations that maybe you don’t have the right people or processes in place, maybe your skills don’t quite match up with a technology that you need. And we go through a bit of a trough of disillusionment. And once we start figuring out where the technology needs to be applied, getting the right people in the right places, we kind of started reaching a plateau of productivity. So today, we’re going to be looking at how both RPA and AI fall into this and whether or not we think they’re living up to the hype. So we conducted a survey with about 100, our readers. And just to get a sense of who they are, these are generally finance professionals not limited to order to cash. This is generally in line with our readership, which is in North America and Europe. And they’re typically one or two degrees removed from the C suite. So again, we had some CFOs take part.

But generally, we’re talking to heads of shared services, global process owners, or heads of accounts payable or order to cash. So we just want to get a sense of where we are in the technology landscape at the moment and what technology these people are using. So perhaps no surprise to you. Again, I’ll talk to the major trends, if you can’t see that these numbers here. But Excel really dominates 95% of people are using Excel 76% still lean on their earpiece quite heavily. But when we get into RPA, and AI, we see RPA at 54%, which is I think pretty high. Nowadays, we have another 52% using in house custom technology. 35% are using AI, so a much lower percentage than we’re seeing RPA. And we also asked about order to cash technology, cloud-based which 22%. So the main takeaway here is that RPA, we would consider mainstream now at 54% of people using it. And AI is still in the very early market, the emerging phase at 35%. This report is also coming out I think later this week if we can get the graphic design ready.

So hopefully we can share that with you as well. So again, I know there’s a lot of numbers here, but we want to understand where RPA and AI are actually being used. So you can see there visually, there’s quite a stark trend here. So RPA in orange is much more widely used across pretty much all areas, and AI in blue is used for fewer in all of these areas. But the big thing that stands out here is that RPA is being used at 63%, that top one to automate simple, repetitive user actions. And the second one there at 50% is document processing. Where we see AI come into place, it’s a little bit more on that bottom of that chart. And that’s in the area of predictive analytics at 21%. And supporting analysts with day to day decisions, again at 21%. So there’s kind of two camps of usage. Here we’re seeing RPA much more widely used on repetitive manual task reduction. And AI is one which less widely used, but it’s used to support human decision making. And we also want to under better understand from our audience, how satisfied are they generally with their level of their automation, and a little bit worryingly, 92% see a lot of room for improvement. Only 8% say they were very satisfied with their current level of automation. 62%. So they, you know, were somewhat satisfied. But a pretty significant third said, they’re not satisfied with their level of automation, we need to see a lot of improvement. For sake of time. I didn’t include all the charts here. But we also said 69% said, they’re just spending way too much time on manual tasks. And we also ask people, if their data helps drive them to make decisions. And only 17% of Yep, our data helps drive helps us make our decisions. So we’re seeing a lot of room for improvement here.

And we want to see how RPA and AI are starting to fill these gaps. So we’ll dive first into RPA adoption. So again, here we’re zooming into just that 54% of people who are using RPA today, and we will understand how transformative how does it impact Your organization. So here, it’s really a two-thirds have had a generally positive experience of 15%. We use it and it’s transformed our processes. About over half, say we use RPA. And it’s had a positive effect. But a pretty significant third said it’s not had a great impact yet. So I would say this is pretty rosy, its RPAS generally had a positive impact, but not transformative on a wide scale. up sorry. And so why is that? What are the challenges coming from that? So implementing RPA is just it’s not without its issues yet. And we see the main challenges here, the top one here at 47% is lack of in house skillset for bot development and maintenance. So a big skill set is a gap between people using RPA and the ability to use it. And again, number two is really tied in quite closely with that 40% said, the ongoing maintenance of bots is a challenge, just looking down the list a little bit less significant. Fortunately, a quarter of people had no challenges, and other people struggled with too many bots or managing BPO partners. So again, the key findings on the RPA side of things are that you know, a third of companies haven’t had a great impact. But you know, it is pretty rosy, about two-thirds having a positive impact. It’s mainly used for automating the more manual tasks, not necessarily more analytical tasks, and about half said that the skill set is a real challenge for them. So we’re going to look at the same data in AI. And we see a slightly different picture here for AI. So again, we’re small Ziering into a much smaller data set here. So this is just the 35% of people who are actually using AI. And it’s pretty much a 50-50 split between a positive or neutral to a negative experience.

So similar to RPA. 14% said, Yep, it’s had a transformative process 33% Better positive experience, but over half 53% said, it just hasn’t had a great impact, or certainly not yet. So digging into those pain points, we saw some significant challenges people saw with AI. So I’ll zoom in on these top two. But looking at the second one is pretty much the same as RPA. If that is just difficult. 48% said it’s difficult to build the in house experience to build a machine learning or AI applications. But what’s a bit more interesting is that top one, so 58% said it’s the inability to fully comprehend and communicate the business potential of AI in your business process. So we’re not actually talking about the skills gap or technical skills here, it’s actually the ability to communicate the vision, what can AI do for me? How do I use it? How do I build the business case? So I think this is really probably more indicative about an early market or more emerging technology is that actually the bigger the biggest problem that people are having is not fully getting their head around the potential of AI. So what we can take away from this is that its AI is just not as widely adopted yet, and is really yet to show its true potential, the main challenges we see is actually communicating the potential of AI, the lack of skill sets still, again, about half say of that as the main challenge. But when it is used, it’s used to more support analytical functions and decision making. So I’m not gonna read through all of this, but we just had some really thoughtful, free text at the end, we asked people, you know, well, what’s been your experience with these technologies. So I just want to give a little flavour of some of the responses.

Some people cited problems, some people had some good insight on AI, and where they’re best used together. So some of the problems that we saw in a few responses, some people said, they had a bit of a tricky start, because they had some kind of air, quote, automation in place that actually had to be taken out and redone before they could actually see a positive return on investment. Other people said that you know, they struggled with things like the cost-benefit was maybe put in by teams like it, and not the actual finance teams using it. So they weren’t necessarily getting the return, based on the cost-benefit that were put in place by people not using the technology. Some people felt AI was more transformative than RPA. And other people just started feeling the limitations of RPA realizing asking to start to ask, What else can it do for me, and we just had one stunning story in there where somebody reduced SGA from 18 billion to 4 billion and a 50% increase in productivity. And they were the ones of the companies that were using RPA and AI together. So just to wrap up on the kind of data findings from the survey, is that the majority of at least our readers were just weren’t satisfied with the current level of automation. Data is just not helping them drive decision making to the extent that they’d like it to RPA is being used to some extent, most people have had a positive experience. But it’s limited at the moment to the more reducing manual tasks and getting the minority are using AI. And it’s a bit of a 50-50 experience is used to power analytics. So, from our findings, do we think RPA and AI live up to the hype? Oh, we would say no, not yet. You know, these tools have been kind of hyped, at least to be silver bullets, that they’re going to transform your finance processes. And they simply haven’t done that yet. Again, like we’ve seen RPA is mainstream now. But it’s limited in its usage.

And that skills gap is still very significant. And AI, we would say it’s still in that kind of emerging stage where people are maybe they’re still getting to grips with its power and its potential. But I think it’s we start seeing more use cases, and the user base and the finance professionals become more informed that this has a lot more potential to flourish. So thanks for the survey findings and then listening to that. And now I’m going to turn it over to Susie who’s going to lead a panel to discuss these findings. Right. Yes, please.

Moderator:

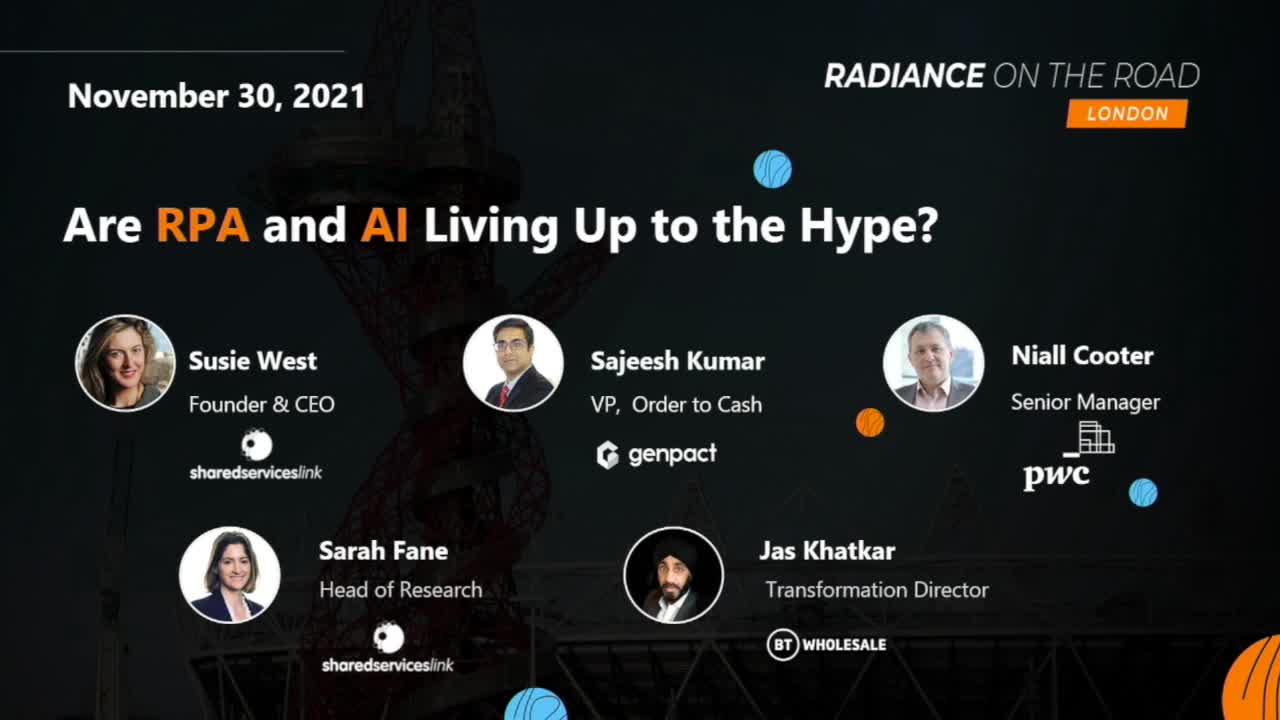

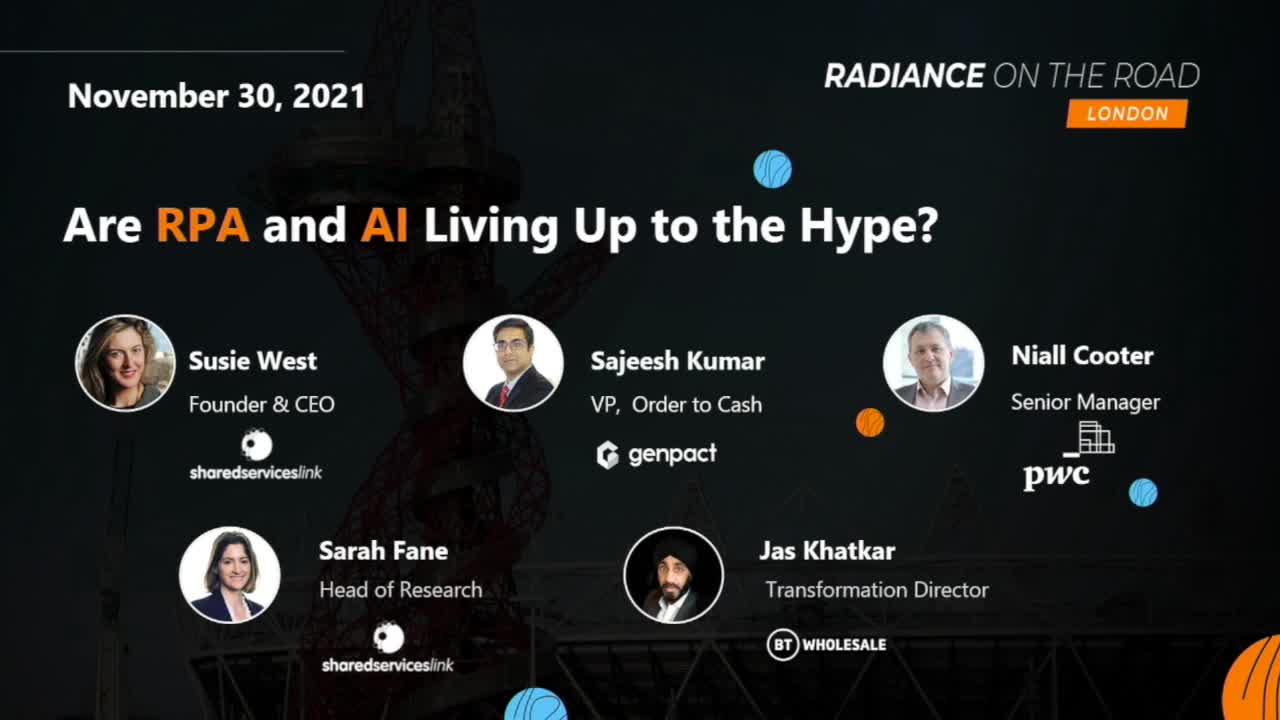

Okay. So, please join me on stage we have Niall Cooter, Senior Manager of PwC, Satish Kumar, Vice President of OTC Genpact and Jas Khatkar, Transformation program director Lead to cash.

Susie West:

Hello, Everybody hears me? It, I’ve been told to stand on this x. So one, I’ll try not to wander too much. But I don’t want to neglect the audience over here. So my name is Susie West. I’m the founder and CEO at Shared Services link. It’s great to be at an event. So thank you very much Highradius for putting this on and doing so well, in putting it on. I worked with Sarah, and have had the pleasure of working with Sarah and Highradius on that report. So welcome my panellists. lovely to have you here. So we’ve got about five questions, which are all really kind of born out of the report that you’ve just gone through. So we’ve got experts here. So we’ve got Niall, Jas and Sajeesh. So let’s start off with the first question. I’ll start with you, please. Jas. So you can see there from those figures, a lot of people still relying on these.

These are multi-billion turnover organizations, our members, by the way, they’re kind of 1 billion-plus turnover companies, the biggest companies in the world, and they’re still relying a lot on Excel and utilizing their existing ERP may be to try and get as much functionality out of that which you can understand, because the investments made. But tell us a little bit about how you can, you know, really look to optimize your order to cash process flow, relying on Excel.

Jas Khatkar:

Well, I think just to reassure people, BGP, one of the biggest global operators in the telco world, still built 40 million a month edge connected to itself is not a widely used building system. And it’s just inherent to most of the processes. But I guess a question for everybody may have been thinking of things. But you’ve heard a lot about your cash automation, but actually going back the other way, who has on complex processes and is surrounded by manual activities? The core processes are quite common. Yeah, yeah, pretty much. I think that’s probably one of the biggest challenges. And I know a BT, and most of my clients I’ve been is the typically we’ll see 20 to 30% of your processes, the little complex, bespoke setups, which really stopped you going wholesale with the automation, because if it doesn’t cover everything, then this starts to devalue, that that implementation for VAT is a lot bigger. And that’s just because the nature is so negative base, so much acquisition, we’re talking about 40 to 45% of our revenue has a manual intervention. So one of the greatest complexities we’re trying to overcome is the connectivity between the business. So we’ve heard a lot about audit cash, but actually, I look across lead to cash, because all of our issues start off in the sales world. Because if we sell something that we can’t even build, then we’re going to have problems in billing and we’re going to have problems in collections and all the rest of inquiries and customer complaints. So If you speak to a salesman, they have no concept of why can’t we build it?

Customers want these things, the standard products, but their standard products, but their standard individually, once you put them all together, then they become bespoke. And that’s where BT has struggled. And that’s where we struggle with RPA. Particularly, because not, not only does the business not understand the audit cash journey, or the lead cash journey but then in the complexity of it, very few fully understand what’s involved in producing a bill, something that should be straightforward, is actually to get the magician in because there is sometimes it’s some magic trick how we produce a bill and that I think, are some of the biggest barriers we have for real adoption of RPA and we’ve started it, we started this journey over the last year and a half and that’s where we struggle is actually who can explain it. Because when you start getting into the detail of the requirements, that’s fine. But you’re missing bits. And when you’re going to automate something unless you know it all. It will fail and it will have exceptions and failures and then that hits the confidence in Excel. So that’s what we’ve seen. Certainly, we’ve seen every day is some of the issues. It’s getting around that complexity of the manual aspect of overheating.

Susie West:

And I’m not that not letting you disappear just yet. Can you tell us a bit more about so you have started to deploy our robots a little bit in order to cash or across finance?

Jas Khatkar:

Yes, we started more at the back end. So around what we found was feeling was obviously his detention most people resonate is anything that goes wrong, Billings a problem. And that’s where all the exact sort of point to MPs will say my billings are wrong, wasn’t what I was expecting. There’s errors, it takes forever to resolve a query. But if you strip that back, it is because the expectations were set falsely at the start. So we’re selling the wrong things, or we have no capability to build it. So what we start to do, and that’s all underpinned by manual solutions, yeah. So we’ll start something, you know what, let’s figure it out manually. So we’ll have an army of people who are then going through Excel and SharePoint and other tools databases to produce that bill, mate and what we’ve looked at is these guys are doing the same activity month on month and they’re just going through, check this site, check that take that data, and then move forward. So I took the approach of or will work there. And we set a goal to automate 90% of the billing activities done by our group billing function.

And we’re just completing phase one and we’ve got about 80% because some things were scoped or contracts, we’re sort of signature phase, we design phase, and we just like to exclude certain things, but we’ve looked at it from that aspect. So RPA is working, it can work, it will automate the activities individually we’re doing it takes the risk out of it puts in controls governance, all the stuff which audit pick up on, and BT was struggling with that. But essentially, it doesn’t move the dial for any of the big metrics is great. We automated so it’s a journey for us in phase two when you can take the really complex stuff and that’s when you can start to influence NPS. So for us, we’ve dropped it into the backend, the billing activities, I think some of the earlier presentations talked about what people do behind the scenes. But the more it comes upstream, that’s when I think it will start to move some of these metrics, and then we can get the additional momentum of buying.

Susie West:

Okay, great. Sajeesh, what’s your take on the same question?

Sajeesh Kumar:

So can you do run your A/R function using legacy systems? Yes, many do. The bigger question is, should you and you don’t need to raise the reality. More often than not when you have a conversation with multiple businesses. There are three reasons that give me one just spoke about the saying I have a very difficult tough tech landscape. Who doesn’t? Right. So that’s one that is not a reason or slash excuse because, given the kind of strides that digital has made over the years, the kind of API is the integrations are much more advanced right now that you’re significantly tough tech landscape need not be so in the future I think Michael also spoke about a few examples of Africa. The second reason that they say is the business case does not stack up to engage in a digital transformation journey. And that’s only because you’re looking at it in silos probably. Are you just looking at efficiency? In order to see efficiencies just an add on. The bigger buck is in the value outcomes, the insights that you drive to the business. So are you considering that in terms of your business case, and the third one that comes across is change management as a reason? Change management is understandable.

If you look at it, if you don’t address the change management issue right now, it’s going to become extremely difficult in the future, as you’ve seen, especially in the pandemic case, where you have to change much more faster. And if it becomes a no option, you have to get to do it. So the reason is that there are options that exist in the digital world interventions and microservices that exist. The first and primary question that you want to ask is, what is your primary objective of getting down onto a digital transformation journey? Are you purely looking at cost, then go the RPA route start from there. But if you’re looking at a broader be a value centre GBS as opposed to a cost centre GBS, then you need to bring in multiple touchpoints on that space. In my mind, I always consider RPA and AI to be two different masters RPA caters to efficiency, purely pure now. You’re trying to reduce the manual interventions, the repetitive tasks, you cannot expect outcomes from them, you cannot expect insights from them. At the same time, AI is less about efficiency. It’s more about what kind of actions business decisions, actionable insights that you can actually try. So it’s a question of asking yourself saying, do I tap into the resources that exist in the digital world today, in order to make the AR function or the O2C function in its entirety. Much easier, simpler and more insight-driven? Or do you want to continue saying that let it run as it runs today? Because then you can use your legacy systems too.

Susie West:

Okay, in the interest of time now, I’m going to come on to the next question, but I think we have a poll. So grab your paddles. I think this is our poll, A/R mixing systems, should you solely rely on them to run your operations? In today’s date? Yes, or No? Driven? Yes. Yes. Which one is the norm? Which one? Thumbs down. Okay, so we all conceptually agree that, yeah, we need to take advantage of systems, solutions that are on the market today and can significantly help us right, let’s move on to the next question. So I’m gonna start with you, please, Niall.

So RPA is more widely adopted than AI today, you can see that, on the report that Sarah was walking through. One of the reasons why we’re not as hyped up about it as we may have been a few years ago is because we’re realizing that that does come with some challenges, some of the challenges around the skills gap, for example, not having a centre of excellence, for example, they’re robots to maintain. So what’s your take on these challenges? And some of the advice that you might give to people in this room who are looking to or in or are in the middle of deploying RPA?

Niall Cooter:

I think RPA is quite a dumb capability. You know, it’s it, there isn’t the thought that goes behind.

Susie West:

Can feel a bit more volume, please. Thank you. Sorry.

Niall Cooter:

I was hoping with a microphone, it would prevent me from having to project. So apologies for that. Yeah, so RPA is, you know, it’s fairly dumb processes, processes that don’t need a lot of thought to be given to the movement of transactions. And I think that’s where strength is. So if you want to do the same transaction, want to get information from this system over here and put it into that system over there, perhaps do this calculation in the middle that technology works fine. The moment you want to, to be a bit more sophisticated in how you treat a transaction. That’s when you need the mind to come into it. And what’s the thing AI is trying to achieve that and will over time I guess, largely achieve that, in the short term is about picking the right solution for the right situation and when I think about the credit and collections environment, I mean, just a bit of my background, I don’t run a credit and collections team. I’m a management consultant, I go into other people’s organizations, and I have a look at what they do. And I try and find ways of helping them to make it better.

So my experiences are what I’ve seen in quite a large number of different organizations. So quite often that RPA solution, risks examples would be for a high street bank, we implemented a technology solution and the people solution to manage their bounced back loans and one of the problems that they had was they didn’t want an API integration from the technology solution we provided into their core banking system, it was just too high risk for them in the timescales involved. So we set up a robotics solution to take the information out of one and put it into the other, it’s just creating another user and a very easy thing to action and we wanted it to make some decisions about the steps that it would take in moving that data, for example, whether to put a credit hold on the account. That’s clearly beyond the capabilities of those systems, especially when you’re in the consumer credit world where you’ve got GDPR and profiling considerations to take into account.

Susie West:

Okay, good. All right, thank you,

Sajeesh Kumar:

Let’s bring in, you have a problem, somebody is doing something manually, let’s put about that. That’s never a long term strategy. That’s one. The second thing does not to customize the bot coding to solve for process problem that exists, do not put a bot in where you should not be doing that activity at all. That’s another challenge that they put across. And the third one that completely misses the verse is industrialization, of course, if you’re going through with RPA, you have to start thinking about its applicability across functions. And maybe going even beyond order to cash looking at an FFA kind of function. And looking at how you can tap into all of that. What normally happens is that you look at a short term engagement, you plug in a few bots there, and your long term strategy might be a much more enhanced digital tech coming into play. And then you suddenly realize that the investment that has gone into creating these bots requires complete Furthermore, investment in turning that around. So always have a more long term vision, when we’re looking at anything digital, not just RPA or AI and then try to look at where those gaps are. Look at use cases, look at feature functionalities of your future state tool that you’re looking at because you don’t want to be creating bots for something that will come across off the shelf. So those kinds of components are what consistently I see as challenges happening in the RPA world. But if you can solve that, it will be.

Susie West:

Okay. Great. Good advice. How about your experiences?

Jas Khatkar:

A slightly different take on it, and just being sort of more pragmatic, because all of this stuff, the height, they said the hype was there. But in practicality, they haven’t really taken off and when you look at it, and certainly we’ve seen BT is every couple of years a project comes along, we’re going to automate all of this, a new billing system is going to come in and after all the bangs and whistles ultimately just become number 26 of the billing systems you already have. Because you have the migration issues and all the other complexities. So even with the best will in the world to get the digital strategy, right and to say we’re going to automate, there is always operational challenges which stop it under sales pressure. In an ideal world, yeah. You said, Okay, we’ll transition everybody over. But in a highly competitive world, you have to be able to cater view for your customers. So these are real issues. And I think if for it to be successful, it is mentioned. So the first question is, can we simplify? What what are we trying to automate?

And if you sort of got a view on that, can you simplify? And should you be doing it anyway? These are the first two questions. We asked whether it’s an outsourcing operation, ask those two questions as you go along. But our approach was we were sort of seeing too many big bang programs fail. And actually taken out a sort of pragmatic view of it to say, right, we’ve got a team here or a service CFU unit that is highly manual, can we automate that? And ours wasn’t a cost aspect, it was a control and audit perspective, and getting bills, right? So it is achievable without going the full digital strategy. It’s just about what you’re looking to solve and how, how pragmatic you want to be about the issues and not sort of dwell on the theory of it and the purism of it.

Susie West:

Okay. Let’s go to another poll. So coming up, paddles out. Oh, okay. Are you currently using any third-party automation solutions for your auditor? Cash, yes or no? Yes, it is lots of yeses. And one no. Okay. Do I go straight to another poll question? Let me see. Okay. Let me I think I go to sorry. I’ll go to this question. Does your future plan include implementing RPA or a combination of RPA and AI? A, let’s do it So, how do you know? Okay, so we’ll go with Yes. RPA and B. Okay, and I think everybody gets that. So this is RPA, AI or just RPA. Okay, so nobody is looking exclusively at RPA. Okay, let’s go on to our third question. So in the context, now we’re talking about AI. So people are generally excited about AI being a bit more of a game-changer. So let’s just dig into that a bit more. To what degree do you actually think AI will be a game-changer for the finance function? Do you have any examples of it so far? Some of the challenges and some of the obvious benefits? Let’s start with you, Niall, please?

Niall Cooter:

I think it will, I think one of the areas we get involved in is helping organizations to build tailored collection strategies for different types of customers, I think this is an area where, you know, historically we might have done all the analysis off the side and come up with some, some segments and, and then design strategies to go with that. I think what AI does is it gives you the opportunity then to actually take that step out of the process and have it more of as a live-in real-time. Segmentation of customers based on much more than just your credit score and value of sales and overdue isn’t that kind of thing, but bringing in much more behavioural type components and I think you then get a much more dynamic collection process that is much more tailored to the challenge of that client at that particular time.

Susie West:

Okay, Sajeesh

Sajeesh Kumar:

So, I’m always a big fan of our RPA and AI together, because it serves two needs and gives a much more rounded of benefit. But if you look at AI, and AI is going to be successful, but let’s look at it from an enterprise perspective, is it going to be successful in one enterprise will depend entirely upon what challenges they’re solving for. So if you’re using a specific use case, and then trying to improve a cash flow situation, or if you’re using a use case, and then applying AI, to actually predict if a claim is going to come in, or if an invoice is going to be paid, then it makes sense. But you cannot just randomly say I have an AI feature, let’s apply it, find a solution within through to see functions that have a business challenge that you’re actually solving for. And you take an example, if you look at a deductions component, and you say that I need to go ahead and pull information documents from the retailer website, and RPA can do that for you.

But once you get that information across, are you actually using models and cognitive AI abilities to actually assess whether it’s a valid claim? And to is that kind of claim going to consistently come from that customer in the next three to four months? That’s much more interesting. So those kinds of components in its, in a combination scenario is much more ideal than having to look at, say, I’ll do RPA, or I’ll do AI, you don’t have a choice, you’ve got to do both.

Susie West:

Okay.

Jas Khatkar:

Yeah. And Niall mentioned, this sort of, by prominent area for analytics is really that insight of your customer base. But the key thing data we hold, most companies will hold a huge amount of insight and data on customers already. But it’s using it. And it’s what insight you want the information to drive, or what you’re going to what you hope to ascertain from the information about your customers. And even that can be done, there are tools out there to do it. But I think some of the biggest barriers are going to really going to be the ultimate decision-makers relying on it. And we’ve seen it used in the collection space in it used in the finance area, on the predictability of behaviour. But ultimately, if we can sort of bringing it in as a core part of that decision making for the C suite around who we selling to who should we be selling to who’s best suited to our products and solutions and how we should be positioning them, rather than off the cuff salespeople go out there and just sort of go in hit field sales or tele sell or internal sales teams.

That’s where it can be really powerful. But there’s a huge journey, I think, in people seeing the benefit, rather than a pie chart or a graph on a set of slides. It’s actually underpinning that this is what you know about your customers. And here’s what we’re using that into intelligence and information to determine a specific route. And I think that’s the real power that has not really been opened up. The tools just extracted, the information has always been there. And I think more exact sort of realizing and then trust on that information than I think it will be I mean, we see in social media will write their algorithms, they develop the desktop leading and all of that everything is predicted. And then your content is driven based on your behaviours. And I think getting that in the enterprise, the commercial world will be the game-changer.

Susie West:

He’s using AI today in finance. Just one just a raise of hands. Is your quality of data, kind of hindering your AI plants at all? Well, not really. No. Okay. Just a little bit. Okay. On that subject. So how good is your data have to be?

Jas Khatkar:

That’s a common issue we’ve seen Yeah, because when you’re doing insight, and you’re going to tailor Australia Do you have that insight? And the answer has to be correct, that you’re going to put debt collection strategies on customers. If you only got half the picture, I, you’re gonna chase them for debt, but they had a credit applied. But that was on a separate system. That’s when becomes a problem. So with you’ve got a data warehouse or plugging into all of those different systems which hold the customer data. A is it right? What’s the master source? Often that can be an obstacle because everyone’s probably got data projects going on for the last 10-15 years. So clean data is key. But again, it’s what question you’re asking that data form, it has to be complete for that. I think we struggled with data integrity, inventory integrity, just knowing what the customers got. Often, we rely on the customer telling us what we got. So we then go visit. So it’s a long journey certainly for some of the telcos.

Susie West:

Okay. good. Thank you. Right, let’s have a look. What have we got here now? No more poll questions. So we can actually put our paddles away. tech stack within order to cash. And I, I’d also like to just add, I mean, what does the ideal tech stack look like for finance in order to cash? And also maybe just bring into that your views on? Should you try and get the most out of your ERP? Or should you use go for core ERP, and add on bolt-on applications? The best of breed applications? What’s, what’s the ideal tech stack look like? And let’s start with the please Niall.

Niall Cooter:

So I think it’s horses for courses, isn’t it? So if you’re, you know, 20 million pound business with 300 customers and each customer getting three invoices a month, you don’t need anything sophisticated to manage that. But if you are like, I think a lot of the organization’s here in a large high volume customers high volumes of transactions, then the more automation and AI that you can put into the process, the more efficient it will be. I strongly believe there are some actions that do require, you know, a credit specialists view and I’m not convinced that AI is yet at a stage where we’ll be able to replace that. So I think you know, the stack is going to be a combination of things, it’s going to be a bit of Process Automation is going to be a bit of AI and it’s finding the right balance and the right processes against which to apply those. That’s where the challenges so that you can get the balance between operational efficiency, quality of control of the end to end process, and compliance considerations that you’re having something like telcos energy, financial services, etc. With performance, because at the end of the day, we don’t just want to reduce the cost of running our process, we want to make sure that’s an effective process to run and deliver, you know, in terms of reduced DSO and maximizing cash flow, should you?

Sajeesh Kumar:

So it’s very easy to say that, hey, you should go hybrid, you should go away from ERPs. But that might not be the answer for everyone. Like Niall was mentioning it is it is specific to that enterprise. I think the question you should ask is what have I invested in my ERP? Which version? Am I getting the best bang for the buck is all the best bells and whistles of the digital world coming across in my ERP? If so, go ahead with it. You can have specific bolt-on applications tagging along and serving some unique purposes. But you can still have ERP doing the heavy lifting. The problem that I always find with ERP is it’s tough to turn around. And businesses face a lot of problems with that if I need to be a child at some times ERP is don’t help us on that regard. Therefore, the SAS platforms, which comes with its own versions of RPAS, API’s and analytic solutions on that regard. So it is about having an enterprise-level view of asking whether this is the path that I want to go with. And then taking into account what is the ROI for that? And what is the business challenge you’re solving for? More often than not, it is very tough to stay away from Bolton’s applications that give you a whole suite of features and functionalities that combine all of these microservices. And if that serves the purpose from an ROI perspective and solving the Business Challenge perspective, and more often than not having O2C as a function that drives insights and outcomes rather than just efficiency. But then that will be the rotation.

Susie West:

Okay.

Jas Khatkar:

Yeah, I think there’s two points. Really here. One is to spills on is that what we’ve seen and certainly where BT has gone going from 12 provisioning systems, 36 billing systems, no CRM effectively. And I think eight sales tools was you’re never going to get a standard view of that. So there’s been a lot of investment in building An abstract layer to say, right, we’re never going to get one. So there’s a lot of investment going if you put a layer across, and it will dig down into those courses and extract the information, bring back and you use the insight. And that’s what’s a big push that we’re driving through. And that can rely on all the existing ERPs, or your existing tools, you don’t have to change anything, you just have to identify what are the product hierarchies or data hierarchies knowing what you need, and where that’s stored.

And then you just go in and get that and extract that information and that’s working quite well. But the second point, I think, is quite critical is who you partner with. The tools are very similar. And who you partner with, this has to align with not only your strategic vision and direction but also the pace and culture of your business. I’ve seen from a consulting side that consultants will come in and that six months ahead of where the business was because they’re on it on a much tighter timeframe, they’re working 14-15 hours a day and then they’re the miles apart on the outcomes. So choosing the right partner that fits, has the vision and can work with the business and take them forward. I think that’s what generates the best results and the relationship and we’ve sort of seen that certain beauty.

Susie West:

Okay, good. I’m going to open it up to questions from the floor. Any questions for our three panellists? The question at the back.

Audience 1:

Sajeesh, you may know this reference. But we see some companies who get fearful about adopting technology because they think that processes and ready to take technology on. And obviously a lot of people today have talked about combining people processes and technology. So how does the panel or maybe the wider audience has overcome that type of challenge, where you’ve got a company who thinks they’re not ready to accept technology because they’ve got to find the full process flow. But actually, maybe technology will show them what the process should be.

Sajeesh Kumar:

Absolutely. Quiet, a lot of times, we get that question of saying, Hey, I like this, but I’m not ready. We’re waiting for the perfect time, we’ll never get to be ready for the fact that you could do is you don’t need to go big bang, you can go use case-specific. So if you’re really worried about, you know, I don’t want to make a big starting point of completely transforming your order to cash well start small, start with cash apps. It’s transactional, try to make it as painless as possible. Therefore, what are the levers that you could look at? I don’t believe that there is this perfect time to engage on your digital transformation journey, at some point of time, you have to take the plunge. But you do have the choice of taking clients in small use cases and then developing it having proof points. And that also helps with the business case, in any case, so you can start small and then grow into it. But you have to start.

Susie West:

Okay, any other comments.

Jas Khatkar:

To start, I mean, some are really fresh, even this morning. So we got a call with one of our accounts that we were told don’t touch as Vodafone here today. Also, so everyone’s like, don’t touch the Vodafone account, we can’t automate it, it’s highly complex and 6 million a month calling the revenue stream. And it kept doubling the scope from the automation journey. We’ll do it once we settle down and all the rest of it blah, blah, blah. And then the account manager has left the business gave the notice and she left this morning. And the billing team offshore. Her full of all left. So then it was getting a call. Can you automate Vodafone, right? So there will be other pressures. And actually, if they did listen to us three months ago, we would have automated already. But there’s a huge risk around now securing that where we can. So as Steve was saying, there’s never be a right lifetime. But in order to really give the control and governance around it, you have to force these decisions. Otherwise something else or force your hand, and then it’s then you’re playing catch up.

Susie West:

Okay, I think there was a question on it.

Audience 2:

Thank you. My question is from an if you think about RPA, from an IP perspective, isn’t there as well, especially if like you do your own thoughts, you know, isn’t there a risk that you’re kind of left behind when you’re not up to speed with innovation? So when everyone else is using state of the arts using solutions that keep innovating, you risk being left behind if all you’ve done is take a process just automated the way it is and just sit on it. What are your views about you know, how do you make sure you continuously innovate so you don’t you’re not behind everybody else?

Niall Cooter:

Yeah, I think my view on that is really that if we are pushing the boundaries of performance and about operational efficiency as well as performance, we shouldn’t ever be comfortable with what we’ve got. We should always be looking to challenge and test whether there’s some better way of doing it, whether there’s some better automation, some better systems and better data to just help us take the state further, because the moment we sit, feeling complacent that we’ve, we’ve achieved the best that we can do. The world will swamp you. Yeah, we saw this in the water sector. You know, they felt that there’s no way where they can take collections performance because their hands are tied behind their back because of legislation because of just the way the water sector works. But in reality, in all 20 water companies stopped about 20 years ago in terms of their sophistication of collections approach. And that was just as disastrous.

Sajeesh Kumar:

I always asked this question is that what is your core skill set? So whenever somebody says that you know, I’m building something in the house, I’m building myself? Do you if your primary objective is selling pharmaceutical drugs, or selling, you know, confectionery? Why are you creating? RPS I look at outside there is crowdsourcing, there are better people who actually bring you the skill set that is required, in order to help you, all you need to be sure of is what business challenge you’re solving for, and that that you are aware of. So, it’s not saying that what is built in house or legacy will not work? Not at all? It does, there are many proof points of it. But do you really want to put that effort in when you can actually put that effort elsewhere?

Audience 3:

Even in your efforts, your money invested in your core business or areas exactly

back?

Susie West:

Can you repeat the question? Not everybody heard it?

Sajeesh Kumar:

Right. I think he does have more of a comment, saying that, you know, focus on your core business rather than trying to have become a tech-oriented company building RPS?

Susie West:

Yeah. Good. All right. Any further questions, otherwise, we will leave them there. Yes. We have a question here. Thank you, Jenny.

Audience 4:

Thank you. So my question is, I’m actually a change manager.

Susie West:

Well done.

Audience 4:

Forgive me if there is one in the room. That’s right. So my question is, I see now with RPA and AI technology, the same mistakes we made decades ago on the ERPs. Right? Because to me, nothing gongs, particularly with ERP, although I’m glad that Highradius product is taken away, are two hours away from the rigidity of the ERP. But the ERP often doesn’t work because of bad configuration, but implementation, not technology, per se. So are we making the same errors now with the RPA, we are badly implementing a badly configuring it and then we are giving the fault to the technology.

Sajeesh Kumar:

I couldn’t agree more, because it’s important to understand that technology is not the solution. Technology is the enabler to the solution. So irrespective of whichever tech, the best tech in the market that you can put across if it is designed wrong, you’re going to have a problem in hand. I always say that any platform, any solution that you’re plugging across, invest in the design component because during the design component is when you’re bringing in process, the tech feature functionalities or times policies, and the unique enterprise needs that might be applicable, either the industry, the market, or whatever it might be you bringing that all together during the design phase, invest in the design, then you will not make the same mistakes of running out a digital transformation.

Jas Khatkar:

When it’s fully out, I’d probably add another step, which would be the mindset. Because often what you find with technology, is people looking at what you do today, can we automate what we do today? Actually, what you need to do is, check why are we doing it this way. And that takes a mindset change in a lot of the senior leadership to say it can be done a different way. And explore that different way. Because once you start looking at the problem differently, the solutions become more straightforward, as opposed to talking yourself out of a solution because you know how problematic your current situation is. And that’s what we’re finding right now is actually if we get away from that always this and it’s not and it’s we’ll lose a customer. We’ll look at it a different way. Let’s change the way we sell. Let’s change the way we discount and pricing commercializes these products. And then you bring in something to the market, which is relatively straightforward to build because billing should just happen. The whole audit cash prize, it should just happen companies made complicated because of all the upfront changes and bespoke aspects that come into it. But I think it was a nature of, of, of the world in the environment. Whereas if you start to think differently now we’re now looking at people like Amazon and getting the front end space done. So you can come in to select what you want. But that’s all great, but you’re going to still deliver it with the same marquee architecture behind the scenes. So that only changes when you’re when your mindset changes.

Susie West:

Okay, I think we have to leave it there, unfortunately. So let’s thank our panellists. Thanks.